- #Chargeback meaning how to

- #Chargeback meaning software

- #Chargeback meaning professional

- #Chargeback meaning free

But they can cause major headaches for companies. Chargebacks are intended to shield customers from fraudulent transactions. When a customer challenges a charge made by your company and requests that the credit card company reverse it, this is known as a chargeback.

#Chargeback meaning how to

We’ll cover how the chargeback process works, how to file chargebacks, illegitimate chargebacks, and more!įrequently Asked Questions What Is a Chargeback?

It can also happen in a physical location or through billing errors.īut when this happens, is there a way to go through a payment dispute process? How can you get refunded for your credit card purchase? The good news is that you can initiate what’s known as a chargeback. But, this also leads to the possibility of a fraudulent transaction or unauthorised transactions. With technology evolving so fast, there are now more ways than ever for customers to make various online transactions. Send invoices, track time, manage payments, and more…from anywhere. Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one placeįreshBooks integrates with over 100 partners to help you simplify your workflows Track project status and collaborate with clients and team members Tax time and business health reports keep you informed and tax-time ready Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

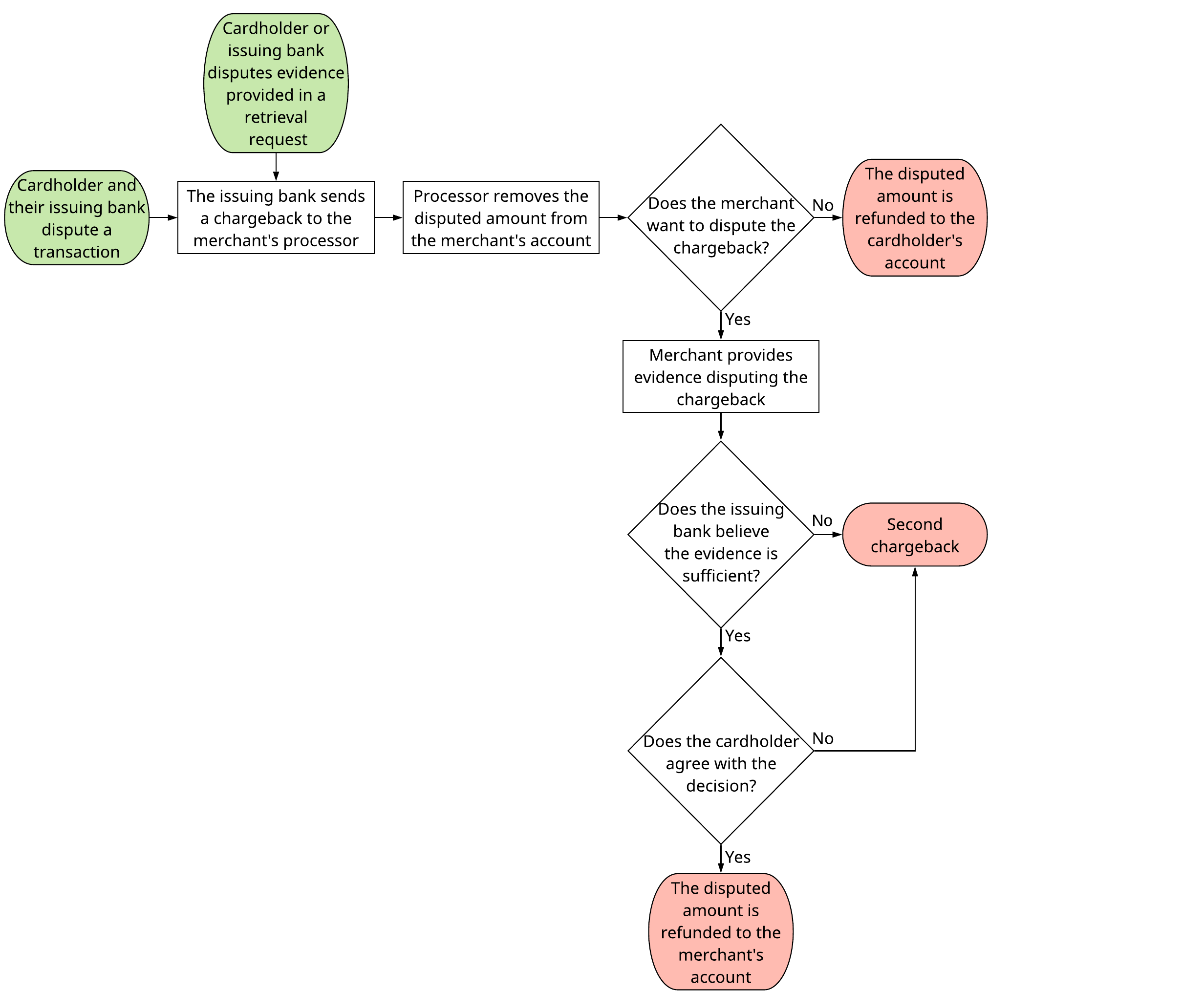

#Chargeback meaning professional

A successful dispute will deem the temporary credit you received to become permanent.Wow clients with professional invoices that take seconds to create At the end of the day, the card network decides who pays.But if the merchant agrees to pay, the process is a bit smoother. If the merchant disputes the chargeback, there may be more back-and-forth as the merchant, acquiring bank and card issuer try to settle the matter.If the merchant gets it, they either agree to pay for the transaction or dispute the chargeback.The merchant's acquiring bank takes one of two actions: Sends the dispute back to the card network and says the issuer is at fault or forwards the dispute to the merchant.The card network reviews the transaction and either requires your card issuer to pay or sends the dispute to the merchant's acquiring bank.If your issuer accepts the dispute, they'll pass it on to the card network, such as Visa, Mastercard, American Express or Discover, and you may receive a temporary account credit. Your card issuer reviews the dispute and will decide if it's valid or if you have to pay.Here's an example of how the process may go, according to Experian: Once you submit a chargeback request, the exact process varies depending on your card issuer, network and situation, but generally results in some back-and-forth between various parties. Anticipate that the dispute can last up to 90 days or two billing cycles, whichever is shorter.

When you submit a chargeback, you may need to include supporting documents, such as copies of a receipt, invoice, contract and any communications you had with the merchant. You may also be able to submit a dispute directly through your card issuer's mobile app. Many card issuers let you dispute transactions by phone, mail or online.

If asking the merchant for a refund didn't work, request a chargeback with your credit card issuer.

#Chargeback meaning free

Investing +More All Investing Best IRA Accounts Best Roth IRA Accounts Best Investing Apps Best Free Stock Trading Platforms Best Robo-Advisors Index Funds Mutual Funds ETFs Bonds Help for Low Credit Scores +More All Help for Low Credit Scores Best Credit Cards for Bad Credit Best Personal Loans for Bad Credit Best Debt Consolidation Loans for Bad Credit Personal Loans if You Don't Have Credit Best Credit Cards for Building Credit Personal Loans for 580 Credit Score Lower Personal Loans for 670 Credit Score or Lower Best Mortgages for Bad Credit Best Hardship Loans How to Boost Your Credit Score

#Chargeback meaning software

Taxes +More All Taxes Best Tax Software Best Tax Software for Small Businesses Tax Refunds Small Business +More All Small Business Best Small Business Savings Accounts Best Small Business Checking Accounts Best Credit Cards for Small Business Best Small Business Loans Best Tax Software for Small Business Personal Finance +More All Personal Finance Best Budgeting Apps Best Expense Tracker Apps Best Money Transfer Apps Best Resale Apps and Sites Buy Now Pay Later (BNPL) Apps Best Debt Relief

0 kommentar(er)

0 kommentar(er)